Les Robb (Pension & Benefits Committee)

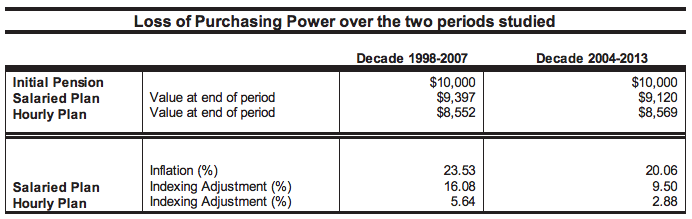

The Fall 2008 MURAnews contained an article on this topic, detailing the extent to which Pensioner increases were keeping up with Inflation. To summarize, over the 10 years ending in June 2007 inflation was 23.5%. Salaried pension plan members received increases of 16.08%. Hourly plan members received 5.64%. Salaried plan members thus had about 2/3 of their purchasing power restored through indexing, while hourly plan members had just under 1/4 of their purchasing power restored. (The difference between the two plans arises because of different indexing provisions — ones that were put in place years ago.)

None of the poor market performance from the recent recession had happened in time to influence the results published in 2008, but it certainly influences the latest decade — the 10 years ending in June 2013 — on which we are now providing information. The major stock market correction that came with the recession, with the corresponding reduction in the rate of return in the plans, has meant that the indexing formulas provided much less increase in our purchasing power in recent years.

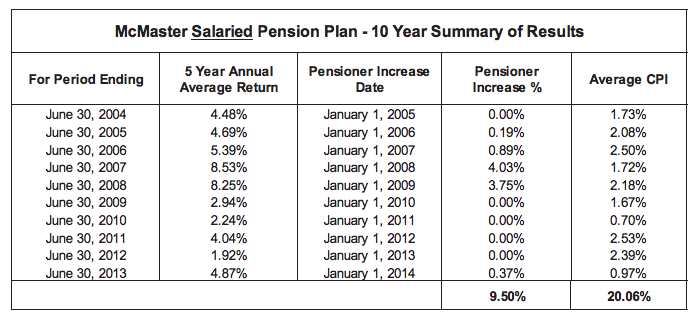

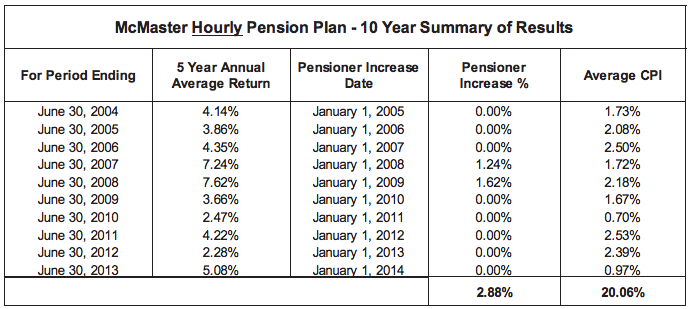

The tables below on indexing performance for the most recent decade (June 2004 to June 2013) show that cumulative inflation was about 20% over the period. The cumulative pension increase for Salaried Plan members was 9.5%. The increase for Hourly Plan members was 2.9%. Thus, during this period Salaried Plan members recaptured just under half of the cost increases due to inflation (47% of the 20%) from the indexing provisions, while the Hourly Plan members recaptured only about a seventh of the cost increases (14% of the 20%). Many of us thought the indexing provisions of the earlier period were inadequate, but the recent period makes it even clearer just how bad the provisions can turn out to be.

The following two tables, one for the Salaried Pension Plan and one for the Hourly Pension Plan, provide the details of the recent experience. The tables are courtesy of Michele Leroux of Human Resources.

Please note:

- The increase payable on January 1, 2008, represents a combination of the Annual Pension Increase (1.72%) and the Supplementary Pension Increase (2.271%).

- The increase payable on January 1, 2009, represents a combination of the Annual Pension Increase (2.18%) and the Supplementary Pension Increase (1.537%).

- The above information is intended to summarize the 5 Year Annual Average Return and Pensioner Increase Percentage History. As it is a summary only, this document is not intended to have legal effect. In the event of any discrepancy or inconsistency, the original documents (audited financial statements) will govern.

Please note:

- The above information is intended to summarize the 5 Year Annual Average Return and Pensioner Increase Percentage History. As it is a summary only, this document is not intended to have legal effect. In the event of any discrepancy or inconsistency, the original documents (audited financial statements) will govern.

Another way of looking at these results is shown in the third table, below, which shows how purchasing power changed over the two different time periods. To make things easy to understand, we look at what happens to the value of $10,000 of pension at the start of each period. Consider first the salaried plan in the earlier period -- after ten years, the $10,000 eroded in value to just under $9,400. In the more recent period, $10,000 eroded to about $9,100. The hourly plan, on the other hand, shows that $10,000 eroded to $8,550 in the first period and to about $8,570 in the second period.

Given the current indexing provisions of our pension plans, what might we expect in the future? Most analysts agree that the “great recession”, which in combination with continuing inflation gave rise to the recent poor indexing performance, was a rare event and unlikely to be repeated frequently. So, in my optimistic mode, I think we might expect indexing in the next decade to be more like the earlier decade than the more recent one, although only time will tell. It would be naïve, however, to think that a negative market correction of the size of the recent one will never happen again.